Definition Of Work U/s 194c

Deciphering The Definition Of The Word Work Under Section 194c. Section 194C of the IT.

Section 194c Tds On Contractors Rates Of Tds

Act provide that any person responsible for paying any sum to any resident for carrying out any work including supply of labour for carrying out any work in pursuance of a contract between the contractor and a.

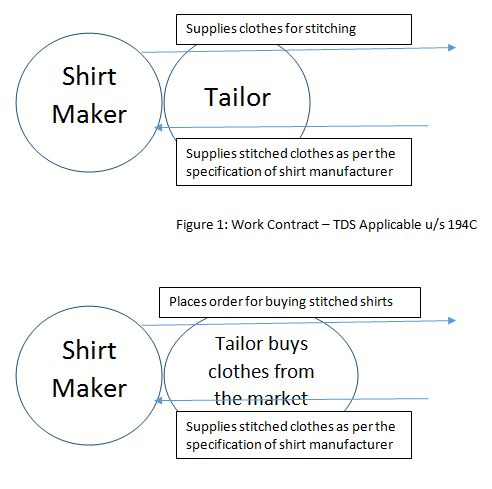

Definition of work u/s 194c. To provide that in a contract manufacturing the raw material provided by the assessee or its associate shall fall within the purview of the work under Section 194C. It was held that the supply of outsourced manufactured goods by the contract manufacturer constituted an outright sale and could not be treated as a works contract within the scope of section 1 94C. Definition of work has been amendment for the purpose of TDS under Section 194C.

The word work comprises the following. Productionsupplying a product based on the specification of buyers by utilising material acquired from the buyer. Sub-clause e of this definition includes manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer within the definition.

R carrying out any work in pursuance of a contract shall at the time of such credit or at the time of payment whichever is earlier deduct an amount equal to one per cent in case payment is made to an individual or an HUF and two per cent in other cases. 14Bang2013 Date of Pronouncement. Clause iv of the Explanation of the section 194C defines work.

1 Any person responsible for paying any sum to any resident hereafter in this section referred to as the contractor85 for carrying out any work85including supply of labour for carrying out any work in pursuance of a contract between the contractor and a specified person shall at the time of credit of such sum to the account of the contractor or at the time of payment thereof in cash or by issue of a cheque. Hope this article helped you to understand the applicability of section 194C. In present situation material is sold and it is not supplied to contractor hence not liable for TDS.

Associate is proposed to be defined to mean a person who is placed similarly in relation to the customer as is the person placed in relation to the. Section 194C of the Act provides for the deduction of tax on payments made to contractors. Section 194C TDS on Payment to Contractor Income Tax - 1 Who is responsible to deduct tax under Section 194C of Income Tax Act 1961.

In other words it encompasses all persons who have paid a resident contractor or subcontractor to carry out any kind of work. Vs DCIT -ITAT Bangalore ITA No. Present type of maintenance work would also clearly fall within the ambit of work.

Section 194C of the Income Tax Act states that any person making payment to a resident person who is carrying out any work in terms of the contract between the specified person and the resident contractor is required to deduct TDS. Consequently the assessee was not liable to deduct tax at source from the. Clause iv of the Explanation of the said se.

As per Section 194C Any person responsible for paying any sum to any resident for carrying out any work including supply of labour for carrying out any work in pursuance of a contract between the contractor and a specified person shall at the time of credit of such sum to the account of the contractor or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode whichever is earlier deduct an amount equal to. Since the word work is defined us 194C in an inclusive manner to include certain specified services viz advertising catering broadcasting and telecasting etc. If Material will supplied by the principle officer then TDS will deducte us 194C at applicable rate For C-2 and NC - 1 and if material and printing both done by supplier then TDS Not applicable.

Section 194C of the Income Tax Act deals with the tax deducted at source TDS that is to be compulsorily deducted from any payments that have been made to any person who is a resident contractor or a subcontractor. Any specified person responsible for paying any sum to any resident-contractor for carrying out any work including supply of labour for carrying out any work in pursuance of a contract. Hence section 194C is not applicable.

The specified person mentioned above means the following The Central or State Government. Also it is not covered in the definition of work as given in the explanation of the section 194C as I produced above. I The provisions of section 194C shall apply to all types of contracts for carrying out any work including transport contracts service contracts advertisement contracts broadcasting contracts telecasting contracts labour contracts material contracts and works contracts.

Whether supply of out sources manufactured goods under contract will be treated as a works contract us 194C. The section provides that any person responsible for paying any sum to a resident for ca. What is Section 194C.

It is proposed to amend the definition of work under section 194C to provide that in a contract manufacturing the raw material provided by the assessee or its associate shall fall within the purview of the work under section 194C. Conveyance of goodstravellers by any method of transport excluding railway. Section 194C states that any person responsible for paying any sum to the resident contractor for carrying out any work including the supply of labor in pursuance of a contract between the contractor and the following.

TDS us 194C not applicable on Hotel Booking Ratnagiri Impex Pvt Ltd. The Central Government or any State Government.

Section 194c Tds On Payments To Contractor Sub Contractor

Section 194c Tds On Payment To Contractor

Tds On Payment To Contractors Or Sub Contracors Section 194c

Section 194c Tds On Payment To Contractor Legalwiz In

![]()

Section 194c Tds On Payments To Contractors Or Sub Contractors Tds On Transport Operator In English Youtube Contractors Payment Definition Of Work

Section 194c Tds On Payment To Contractors Taxway Global

Section 194c Tds On Contractors

Section 194c Tds On Contractors Rates Of Tds

Should You Deduct Tds U S 194c In Absence Of A Written Contract Professional Utilities

Tds On Job Work U S 194c Material Provided Or Without Material Simple Tax India

Define Section 194c For Tds On Payment To Contractors Sag Infotech

Faqs On Tds On Contracts Section 194c

Tds On Job Work U S 194c Material Provided Or Without Material Simple Tax India

Tds On Payment To Contractor Sec 194c Of Income Tax Act Abc Of Money

Tds U S 194h Understand The Concept Of Tds On Commission Or Brokerage By Tax Rules Understanding Concept

Section 194c Tds On Contract Rates Threshold Limit Legalraasta

Section 194c Tds On Contractor Tds Rate No Tax Deductible Faqs

Section 194c Of Income Tax Tds On Payment To Contractors

Section 194c Tds On Payments To Contractors Or Sub Contractors Tds On Transport Operator In English Youtube Contractors Payment Definition Of Work

Post a Comment for "Definition Of Work U/s 194c"